Today’s blog has the answer to one of the reasons you may not be getting ahead and stuck spinning your wheels. This one little word – uninterrupted compounding- can change it all.

You have been told to focus on interest rates and I am here to tell you it’s not about the interest rate itself, it’s also about the type of interest. This is another one of those things you are not taught to look at. Instead, you are sold based on monthly payment. Bigger issues are what is being lost in that monthly payment.

This is such a misunderstood topic that it takes some time for people to grasp and the initial reaction is ALL interest paid is bad. That is not the case when you are looking at the type of interest.

There is a difference between uninterrupted compounding and amortizing interest and the difference is huge!

Uninterrupted Compounding: This is when interest is added to the principal balance, again and again, each month, quarter, or year. This is an ever-increasing event that is never interrupted to allow for maximum growth of your money.

Amortizing: This is when your interest amount is set based on the principal at the time a loan is taken. The interest is set for the loan and as you make payments you pay down the interest, with the last payment being very little interest and mostly principal. These are your car loans and home loans.

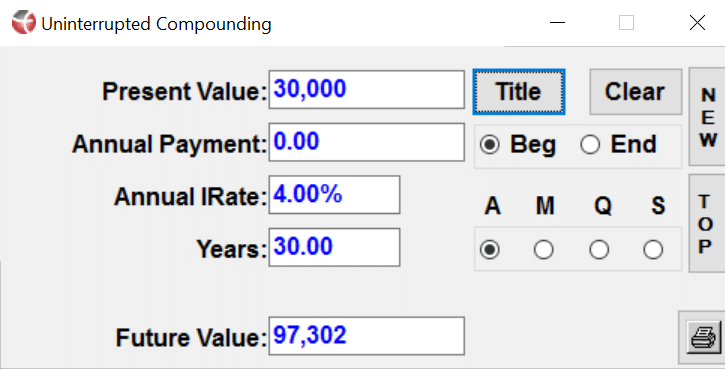

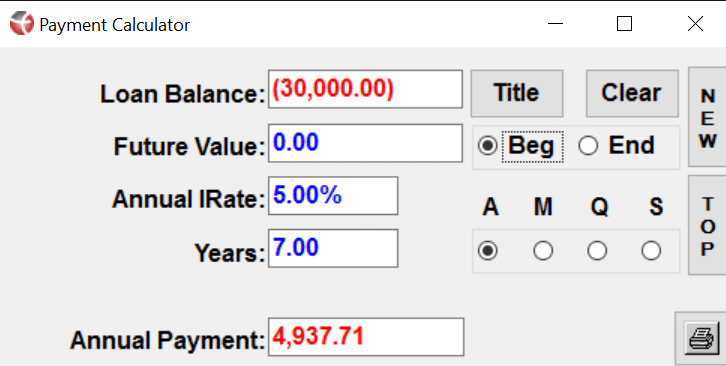

To illustrate the difference between the two takes a look at the below graph. This graph represents the effects of compounding vs amortizing interest.

First, you see the power of uninterrupted compounding of $30,000. The total over 30 yrs is $97,302, a gain of $67,302.

Now you see if you had purchased a $30,000 piece of equipment at 5% your payment over 7 years would be $4,937.71 per year. Seven years of payments are 34,563.97, which is lost interest of $4,937.71.

If you made four of these purchases over the next 30 years you would have lost $19,750.84 to interest for the use of this money, but your money over those 30 years was NOT interrupted so you earned $67,302.

That is the power of UNinterrupted compound interest.

You do not want to have a loan with compounding interest because it will continually increase and you’ll never get ahead with. Credit cards, home equity lines of credit and student loans have compounding interest. Some student loans compound daily! You all know credit cards compound monthly. Most have no idea that home equity lines of credit have compounding interest monthly as well.

How to Get Ahead

What you want is to put your money in a place where you can earn uninterrupted compounding interest. This one little thing alone will make a huge difference in the amount of money you are holding later in life. Just think if you had ten dollars and turned that into $20, then $20 into $40, and $40 into $80, and $80 into $160, and $160 into $320. See how fast that grows, this the effect of compounding.

Summary

In summary, do not just look at that interest rate alone. Make sure you are asking what type of interest you are paying or earning. Make sure you are finding a place to put your money where you can earn uninterrupted compound interest. There is only one place that I am aware of and it’s dividend-paying whole life insurance if there was another tool I would have money there too. The stock market is compounding but it’s not uninterrupted, there is a difference there too.

It’s about allowing your money to work while you use someone else’s.

Mary Jo

0 Comments