Table of Contents

“It’s a Scam!”

“Does it really work?”“She’s hiding something, there has to be a catch.”

“If it was so good everyone would be doing it.”

“Everyone knows whole life is bad.”This list could go on…If you didn’t say it yourself, you may have heard someone else say it when you told them about Farming Without The Bank. It’s human nature to believe things are too good to be true.

Farming Without The Bank is a system based off the Infinite Banking concept that I believe in passionately! But it IS a mindset shift. That makes it difficult to believe in for people who don’t like change. People who say things like, “Well, that’s the way we’ve done it for 100 years…”

I don’t want you to be stuck in a 100-year-old system.

I want to help you take control of your farm’s financial operations using the most up-to-date strategies available and have liquidity, control, and guarantees with your money.

When you talk to folks about these new strategies and get negative feedback, consider the source. Is the person knocking whole life insurance a licensed insurance agent?

Is he knowledgeable about the insurance industry?

In most cases they are not, they are basing their judgments on hear say not facts..Do you need facts? I had a client ask 14 people about it and they all told him he was being lied to. It doesn’t work.

Then he asked his banker. His banker told him he’d be silly NOT to buy it. The banker could see the value with open eyes rather than preconceived notions others put in her head.

Let’s take a look at 3 Examples.

In the first one you’ll see the illustration given to the client when they policy was purchased. Each example includes an inforce illustration, which is an updated illustration showing actual numbers today based on what the client paid since the inception of the policy.

The illustration is an important tool for projecting what will happen to the policy. We can compare the projection to what is actually happening today, by looking at an inforce illustration. Is the growth what they expected?

Inforce illustrations are a great way to show you that dividend paying whole life does what the company and I say it will do.

A couple of things to note when learning from these examples:

1. All premiums were paid as projected.

2. LOANS were TAKEN!

3. Some loans have been paid back and some have not.

4. All policies are going into their 7th year.

If you’ve read my books or heard me speak, you’ve heard me say, “Loans do not affect your cash value growth because you borrow AGAINST it,” Now you can see it.

EXAMPLE 1

In the first example, a premium of $6,400/year has being paid. The guaranteed seven-year cash value projection is $9,031+$29,727=$38,758.

The Non-Guaranteed seven-year cash value projection is $43,111

Right below that is the inforce illustration from the day I wrote this blog post. Line one represents year seven – – today.

The Guaranteed side shows a cash value of: $11,602 +$29,727= $41,329

The Non-Guaranteed side shows a cash value of: $42,219

Wow! The company is off a mere $1,100 on the non guaranteed side but up by $2,571 on the guaranteed side.

INFORCE ILLUSTRATION:

Why is the guaranteed side so much higher?

Because the guaranteed side is showing the projected value if dividends are not paid. However, that has not happened in 140 years. Dividends have been paid for over 140 years. Once dividends are paid to the non-guaranteed side, that dividend is “assumed” and moved over to the guaranteed, increasing the value.

EXAMPLE 2

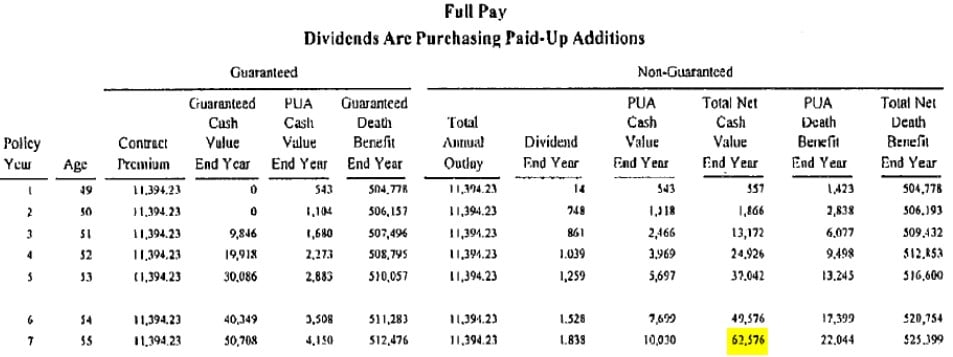

The Guaranteed seven-year cash value projection is: $50,708 + $4,150 = $54,858.

The Non-Guaranteed seven-year cash value projection is: $62,576.

You may have noticed the low cash value in the early years of this policy. That is not typical, but due to health ratings for this client we had to put most of the money toward the death benefit. However, you can see the cash value still grows at a good rate and is very close to what was projected.

Shown below is the inforce illustration. Line one represents year seven – today.

The Guaranteed side shows a cash value of: $55,617 + $4,150 = $59,767.

The Non-Guaranteed side shows a cash value of: $61,052.

INFORCE ILLUSTRATION:

EXAMPLE 3

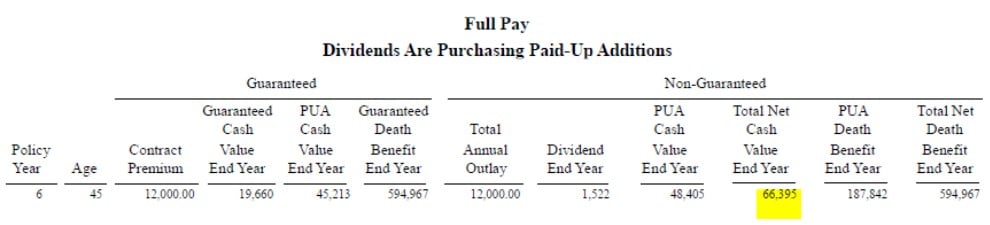

The Guaranteed seven-year cash value projection is: $16,468 + $45,213= $61,681.

The Non-Guaranteed seven-year cash value projection is: $67,169.

The inforce illustration was saved on the day I wrote this blog post. Line one represents year seven – today.

The Guaranteed side shows a cash value of: $19,660 +$45,213= $64,873.

Non-Guaranteed side shows a cash value of: $66,395.

INFORCE ILLUSTRATION:

After seeing these three examples you may be asking, why is the guaranteed side so much higher than projected? As stated above, the guaranteed side is showing the worst case scenario–a dividend never being paid. However, dividends ARE paid, increase the value, and once paid they are assumed and will not be taken away!

What is the big takeaway here?

WHAT THESE EXAMPLES PROVE:

If you put money into a tool that projects future cash value nearly exactly while leaving money LIQUID without giving up CONTROL and with GUARANTEED cash values higher than they expected, this strategy cannot be denied!

In each real-life example the policy owners took loans from the policy to do other things: buy a vacation home, take a long vacation, and buy equipment for their business.

It doesn’t matter what it’s used for! After all, the policy owner is in control!

Looking back at older policies confirms that even the market crash of 2009 did not harm the policy performance.

Traditional money management cannot do what we do here: offer liquidity, control, and guarantees along with discounted dollars to leave to your family upon your death. If you have land, there is no guarantee that land value will increase. You have to sell it to have the liquidity. (don’t forget to take off the fees for realtors and such).

If you have an investment such as an IRA there are NO guarantees or liquidity. Borrowing against an IRA affects the growth of your IRA. In addition, your IRA is not even worth what it shows on paper. You will pay taxes and/or penalties for withdrawal and lose the growth from the money that was removed.

Moral of the story: the next time someone suggests to you whole life insurance is a bad tool ask them to show you the proof of their money growth with liquidity, control, and guarantees.

Remember, if you’ve read my book – you are more of an expert on the matter than most “professionals” out there. If you have read the book, t’s time for us to meet. Message us on Facebook for the link to schedule. If you have NOT read the book, I hope this article clarifies a few of the details. The book will explain more about the strategy and our FREE 1-hour consultation will define the details and how this strategy would work in your operation. So – What are you waiting for?

As always, I appreciate your comments or questions!

Mary Jo

Mary Jo is proud to be a Certified Infinite Banking Practitioner helping family farms keep more of the profits, create financial systems, and bring financial clarity to an uncertain industry though correctly structured whole life insurance policies.

Need More Information? Use these books and learn what tool can take away the worry.

MORE FROM THE BLOG:

Your content here…

Enter your text here…

0 Comments