It’s Tax Time. I am not sure I know a farmer who doesn’t hate this time of year. You do everything you can do lower taxes.

What about making money on those taxes?

If you are one of those who is paying, there is something I want to bring to your attention BEFORE you give the IRS your money.

Your loss will far exceed what they are asking for!

Here is why and I am going to explain it with a scenario.

You are 55 years old and your tax bill is 80,000. You have this in a savings account, you go to your savings account, withdraw the money and pay the IRS.

You just GAVE them $80,000 that you will NEVER have again to earn interest on. Money that is gone forever.

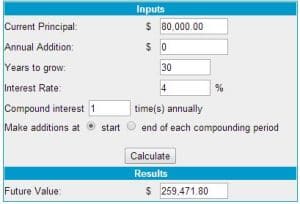

Had you put that money into a system that would pay you 4% interest on that $80,000 the rest of your life, even while you used it to pay taxes what would you have had? $259,471!

By paying cash for your taxes you lost an additional $76,020!

Paying taxes is bad enough why make it worse? If you have to give the IRS money you may as well get something in return and do it correctly.

Now, this was based on a 55-year-old with $80,000 of taxes. What is your number? There are all kinds of compound calculators online you can use to figure this out. I use MoneyChimp.

I hate to add insult to injury here but this is only one year! What about all the years prior you have paid in and after this? What is that going to add up to?

To learn more about how you can stop throwing your money at the IRS and making them rich call me at the office – 701-751-3917 or look around the site to get more information. The how it works video is a must watch.

Happy Tax Season.

Mary Jo

0 Comments