Here we go again. Not sure about you, but I am tired of hearing myself talk about these horrible policies. However, there are so many of them out there they seem to find me, and each time I get all riled up and start seeing red.

It is understandable that agents only know what they are taught. We rely on our teachers to tell us what we need to know. If new agents believe the stock market is a great place to park money, then they will believe these Universal Life policies will survive the test of time and continue selling them. As we all know, I am NOT the person who has faith in the market, but I don’t have to be to see these things fall apart and leave the client out to dry. The below annual report proves my point yet again.

As you can see, this insured was 34 years old when the policy was issued, just three short years ago. This is what you are looking at:

Beginning Account Balance: $240.68

Premiums paid by the insured: $1,252.68/year

Interest earned in the policy: $8.82

LESS = this is where we start subtracting fees and charges!

Premium Load: $250.56

Cost of Insurance: $215.31

Other Expense Charges: $549.00

Total expenses: $1,014.87

Ending account Balance: $487.31

Let’s Break it down:

Percentage of premium paid that is going to fees and charges: 81%

Rate of Return in this policy for the last 12 months: -67.56%

To top it all off the insured has NO cash value! There are surrender charges of $5,145 and no cash value to use in any manner. Even if he cancels the policy he gets NOTHING. Big fat zero.

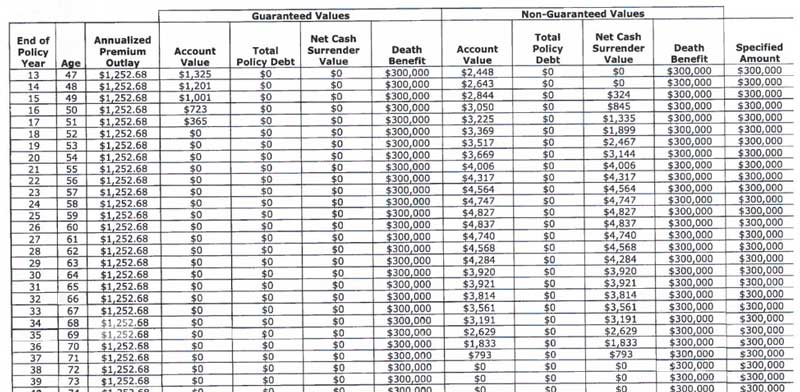

If I look at the inforce illustration he sent over I see that the policy will have ZERO cash value at age 51 on the guaranteed side and age 71 on the non-guaranteed side. What that means is, worst-case scenario, if this policy makes a 2.5% GROSS rate of return with the current expense ratio, it will have cash value until age 71. If the expenses are raised, it will only have cash value until age 51.

There is one saving grace in this policy, the agent wrote this with a guaranteed death benefit. This means when the cash value hits zero the policy will not lapse. Instead, the insured will have a death benefit with no money. So, in essence, he is paying for term insurance for the rest of his life. Buyer beware here, also, be sure to read your contract on these guaranteed death benefit policies. It sometimes states that if you are ever late with one payment this guarantee can go away! Know your fine print before it’s too late.

There is no opportunity to borrow against this policy now or for retirement. There will be very little to borrow over the years, since it never accumulates more than $4,837 on the NON-GUARANTEED side! This is the best side to look at, and that even sucks. What about retirement? What about it, there is NOTHING left but death benefit. That is proven on the illustration.

Take a look yourself:

I have to be honest I have seen a lot of bad universal life policies but I have never seen one this bad on someone so young.

You as the consumer need to make yourself aware of what you are buying and what the difference is between whole life and universal life. It’s sad that you have to do this, but not all agents understand what they are selling and very few educate their clients. It is our job as agents to educate you on what you have and why you have it. If your agent is out to collect commission, run like hell!

In addition, you, the consumer, must stop buying life insurance like you are going to Wal-Mart and stop chasing a rate of return! If you want a rate of return go buy an IRA. Don’t put your life insurance at the risk of the stock market and a stock company that charges nearly $550 of fees for God knows what.

Be sure to look at what you are buying. Look at that illustration and have your agents explain it to you until you understand. If they can’t do that, why are you doing business with them?

Take a look at what you have, don’t assume it’s whole life just because it has cash value. If you are curious to see how it’s performing, ask your agent for an inforce illustration and look to see how long that cash value goes before it hits zero. If you need help with it let me know. I’m happy to help, just as I did with this insured.

If you have not read either of my books, Farming Without the Bank or Wealth Without the Bank or Wall Street, you will see more information on how a correctly structured life insurance policy should work. You can get them at either www.farmingwithoutthebank.com or www.withoutthebank.com.

As usual, let me know how I can help.

Mary Jo

Phenomenal breakdown